Some self-build home mortgages are only for building a totally new property nevertheless most of the products readily available now appropriate for residential property improvement and also work in much the same way. If you've gotten a site with a linked agreement to construct a property on, you should paystamp obligation on the complete website expense and building cost, leaving out VAT. Each stage of the construct have to be certified by a main certifier before a settlement is released. Some lending institutions provide the choice of a rate of interest just home mortgage for the initial 12 months, to aid keep expenses down in the very first year.

- However, further stage settlements could be held back until full comprehensive consent remains in area.

- Making your residence energy effective is a significant way you can support taking on climate change-- while saving on your energy bills.

- In a self-build mortgage, the loan provider advances funds in stages as the job is finished enabling you to move onto the following stage of the develop procedure as much as the conclusion of building.

- Mark Stevenson has been a building and construction professional for almost three decades, with a professional knowledge of wood building and construction.

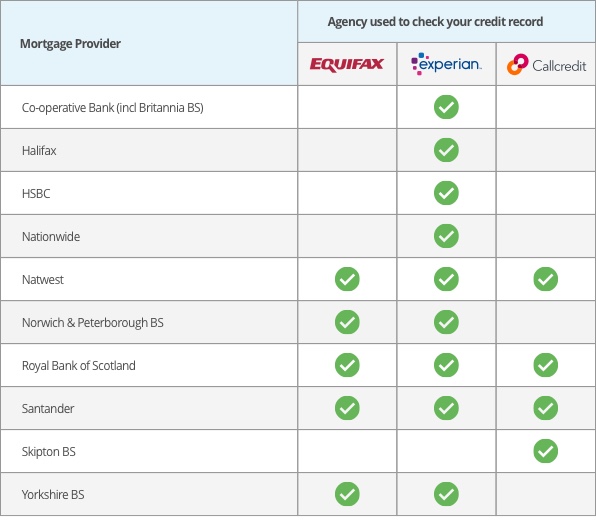

- Lenders will certainly likewise reviewyour debt historyand revenue to make sure that you fulfill theiraffordabilitystandards, specifically for candidates that currently have a main mortgage.

- They have whole-of-market accessibility, indicating that they get access to offers that aren't always readily available to the public.

Yet you will certainly need to inspect if your self-build home loan bills a very early payment charge. Just how much you can obtain in overall will rely on several aspects including your revenue, your self-build strategies, your credit report and your outgoings. This quantity, alongside your deposit, requires to cover the entire cost of the construct and also the land. For instance, when you put in structures, with an advancement phase settlement alternative, your self construct lender will offer you the agreed amount for this stage prior to you begin. This implies you can buy the products as well as spend for work utilizing your mortgage. The amount paid out from your self construct home loan per phase is a percentage of either your actual costs or the value of the jobs.

Self Construct Home Loan Deposit

Whatever your situation, at OnlineMortgageAdvisor we know that every person's circumstances are various. That's why we only deal with professional what is a timeshare and how does it work brokers that have a proven track record in securing home loan approvals. Uswitch Limited is a credit report broker, not a loan provider, for non-mortgage consumer debt products. With self constructed residential or commercial properties, you just owe stamp duty on the land you paid to improve.

Indemnity Insurance Coverage When Acquiring Or Selling Residential Property

With lots of people needing aid as well as few home loan service providers lending, Pete discovered terrific success in going the extra mile to discover home loans for people whom lots of others considered shed causes. Funds begin with ₤ 10,000 with both the interest rate and overall quantity relying on your situations as well as monetary circumstance. Total loan settlement is 6-- 18 months, with your home serving as security. The consumer makes regular monthly settlements of as much as 35% of the car loan for approximately 35 years. EBS has variable and set rates of interest and only provides for property in Ireland. Ecology distinguishes how to sale a timeshare by specialising in self-build jobs that meet particular Power Standard ratings or that promote lasting living.

Benefits And Drawbacks Of A Self Build Home Loan

This indicates numerous self construct house owners avoid paying stamp task, which can conserve them hundreds of extra pounds. The materials as well as work might seem costly to begin with, yet several self construct home owners often tend to find that their residential property's worth upon conclusion becomes a whole lot more than it cost to build in the first place. With a basic mortgage you can take down a deposit of around 10% to 20%, yet with a self develop mortgage, you require to install even more of the cash in advance. Lenders will normally be cautious when it involves a self develop task, so it's important to be as prepared financially as possible. The last couple of payments been available in when the roofing has been built as well as secured, when the interior wall surfaces have actually been plastered, as well as lastly when the entire house has actually been totally developed. Self construct mortgages, as the name suggests, are mortgages that finance your task to build your own residence.

If you need to sell your existing residence you Helpful resources may then reside in a caravan on website, or with family members, or lease a house while the brand-new house is built. With this in mind, it's important to talk to a whole-of-market broker for the best suggestions and to ensure you wind up with the most beneficial prices. There are no limitations on obtaining a self develop home loan in the UK either in your individual name or in the name of a minimal company.

It's always recommended to seek advice prior to dedicating to a huge monetary choice. By directly coming close to a lending institution you can be losing out on the best deals, which is where the specialists we collaborate with can aid. They have whole-of-market access, suggesting that they get accessibility to offers that aren't necessarily available to the general public. Lots of lenders due to the complicated nature of self-builds will only work with people if they experience Buildstore. To find the best lending institutions that are presently using self-build home mortgages, make a query. The specialists we work with deal unbiased advice and can find loan providers based on your personal requirements.