Other, less usual types of home mortgages, such as interest-only home mortgages and payment-option ARMs, can entail intricate payment routines and also are best made use of by sophisticated consumers. Once a customer as well as vendor agree on the regards to their offer, they or their agents will certainly satisfy at what's called a closing. This is the time the debtor makes their deposit to the loan provider.

The term mortgage refers to a car loan used to purchase or keep a residence, land, or other sorts of real estate. The borrower accepts pay the lender with time, commonly in a collection of regular settlements that are divided into major and also passion. A consumer has to obtain a home loan with their favored lending institution and ensure they meet a number of demands, including minimum credit history and down payments.

Some USDA fundings do not require a deposit for eligible debtors with low incomes. There are additional costs, though, including an in advance charge of 1 percent of the car loan amount as well as a yearly cost. If you have a strong credit report and also can manage to make a sizable down payment, a traditional home mortgage is possibly your finest pick. The 30-year, fixed-rate traditional home loan is one of the most popular option for buyers.

The amount you'll be able borrow is based both on how much rental fee you think you can obtain for your current home, together with your income as well as other economic scenarios. Allow to Buy home loans can be quite complex, as well as the series of bargains available might be quite restricted, so it's well worth consulting on the very best options to suit your requirements. Tracker home mortgages, as the name recommends, track a nominated rate of interest, plus an established portion, for a specific period of time. When the base price goes up, your mortgage price will increase by the very same amount, and if the base rate falls, your rate will decrease. Some lending institutions set a minimum price listed below which your rates of interest will certainly never go down yet there's typically no limitation to exactly how high it can go. Where the funding is protected against any kind of movable residential property it is called a promise while where the financing is safeguarded against some stationary residential or commercial property of the debtor it is called a mortgage.

The 5/1 hybrid ARM is an adjustable-rate mortgage with a first five-year fixed rates of interest, after which the rates of interest changes every 12 months according to an index plus a margin. The benefits of timeshare ownership expense of a home mortgage will rely on the sort of car loan, the term, and also the rates of interest the lending institution fees. There are a number of government-insured finances that can make homebuying more easily accessible.

- Mortgages where the monthly repayment and interest rate stays the very same for 3 years are called 3/3 and 3/1 ARMs.

- Usually, individuals with a rate of interest only home loan will spend their home mortgage, which they'll after that make use of to pay the home mortgage off at the end of the term.

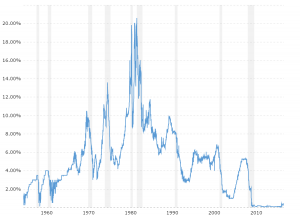

- A rate of interest refers to the quantity billed by a lender to a borrower for any form of debt provided, normally expressed as a percent of the principal.

- These specific ARMs are best if the homeowner intends on residing in the home for a period above 5 years and also can approve the adjustments later.

- A home loan by conditional sale is when the mortgagor sells the residential or commercial property to the mortgagee on the condition that the sale will come to be absolute if there is a default of settlement.

Nonetheless, the FHA program offers down payments for as low as 3.5%. This suggests customers do not have to stress over conserving as much for their down timeshares cruises payments, as well as they can conserve their money for repairs of emergency funds. Present Funds.The FHA is one of the only lending institutions that are extremely positive in securing their candidates' ability to accept monetary gifts for settlements. A candidate can accept approximately 100% of the down-payment in the form of a present from a family member, pal, employer, philanthropic team, or government homebuyer program. You will need to follow the process to approve the present though. VA car loans are assured by the United States Department of Professional Affairs.

Types Of Home Loan: Which Is Best For You?

Our mortgage advisers understand exactly how complicated the home mortgage market is as well as they're happy to respond to any inquiries you have. Home Mortgage Best Acquires Usage our search to discover the choice of the very best home loan deals. In order to secure various traditional home mortgages prevailing in various components of the nation, condition was established by the legislation.

The 15-year fixed-rate home mortgage is the most effective sort of mortgage and the only one we at Ramsey ever before advise to home buyers since it has the lowest complete cost contrasted to any various other kind of mortgage. The rate of a home is typically much higher than the quantity of money most homes conserve. Therefore, home mortgages permit individuals and also households to buy a house by putting down only a relatively little deposit, such as 20% of the purchase rate, as well as getting a loan for the equilibrium. The financing is then protected by the worth of the residential or commercial property in case the borrower defaults. Financial institutions, cost savings as well as funding associations, and also lending institution were virtually the only sources of mortgages at one time. Today, a burgeoning share of the home loan market includes nonbank lending institutions, such as Better.com, LoanDepot, Rocket Mortgage, and also SoFi. For instance, a residential buyer promises their residence to their loan provider, which then has an insurance claim on the building. This makes sure the loan provider's passion in the property ought to the purchaser default on their monetary commitment. When it comes to a repossession, the lender might evict the locals, offer the residential property, and make use of the money from the sale to settle the home loan debt. On an adjustable-rate loan, the rates of interest differs along with the broader financial market. It's likely to fluctuate throughout the car loan, which can trigger big swings in your mortgage repayments. There are so many alternatives to pick from, and also in order to make the most effective monetary choice for you and also your household, you should recognize the differences between each. Utilize this overview to find out more about each mortgage kind and also exactly how they might work for you. VA mortgage.The VA home mortgage lending is also federal government released.

What Is A Commercial Property Car Loan?

You can normally only borrow a lot with common home mortgages. This is typically half a million to a million dollars relying on the regional expense of living. When rates of interest are higher, you usually obtain a discount on the first price versus a fix-rate home loan and are wagering that rates of interest will certainly stay the Visit this page very same or go down. For instance, claim your home loan is for the existing federal funds price plus 3%.

Who Should Obtain A Dealt With

One of the most crucial points to consider when getting a residential property is the sort of mortgage you get. Lots of loan providers permit you to protect a new offer several months ahead of time, permitting you to change across as soon as your existing price ends, and also prevent relocating to a greater SVR. The drawback is that if interest rates fall, you will certainly be locked into your dealt with price bargain. Some home mortgages nonetheless, are set up on an interest-only basis. This implies you repay the passion you owe each month, but not any of the funding you've borrowed.